A lower ratio means you have lots of working capital tied up in outstanding receivables. You may have an inefficient collections process, or your customers may be struggling to pay. Use your ratio to determine when it’s time to tighten up your credit policies. You can use it to enforce collections practices or change how you require customers to pay their debts. Customers struggling to pay may need a gentle nudge, a payment plan, or more payment options.

Would you prefer to work with a financial professional remotely or in-person?

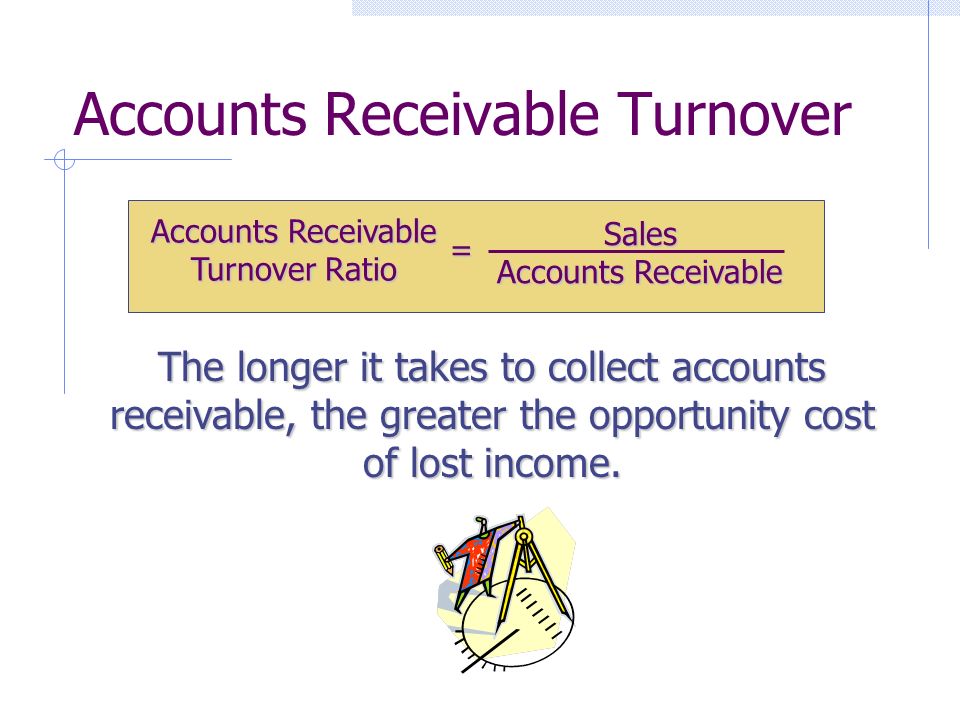

One of the top priorities of business owners should be to keep an eye on their accounts receivable turnover. Making sales and excellent customer service is important but a business can’t run on a low cash flow. Collecting your receivables is definite way to improve your company’s cash flow. To calculate the Accounts Receivable Turnover divide the net value of credit sales during a given period by the average accounts receivable during the same period. An average for your accounts receivable can be calculated by adding the value of the accounts receivable at the beginning and end of the accounting period and dividing it by two. A higher turnover ratio means you don’t have outstanding receivables for long.

What is your current financial priority?

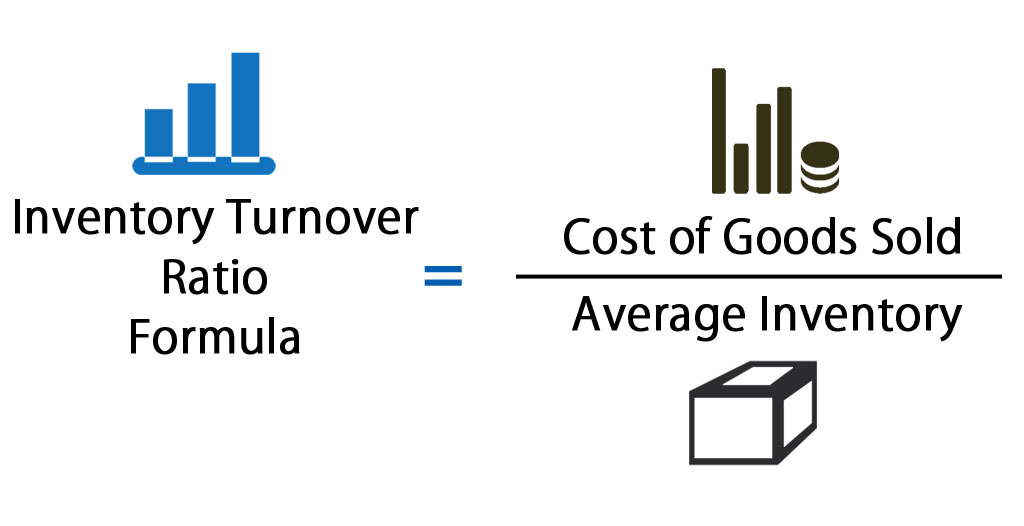

These short term solvency indicators measure the liquidity position of the entity as a whole and receivables turnover ratio measure the liquidity of accounts receivable as an individual current asset. It is much like the inventory turnover ratio which measures how fast the inventory is moving in a business. Generally, a higher receivables turnover ratio indicates that the receivables are highly liquid and are being collected promptly. A low turnover ratio may also be caused by the entity’s own inabilities, like following an inappropriate credit policy or having defects in its collection process etc. Maria’s receivables turnover ratio is 6 times for the year 2023 which means it, on average, has collected its receivables 6 times during the year. To analyze how efficient the company has been in collecting its receivables during this period, it can compare this ratio with its competing entities as well as the past years’ ratio of its own.

Accounts Receivable Turnover Ratio Calculator

Although this metric is not perfect, it’s a useful way to assess the strength of your credit policy and your efficiency when it comes to accounts receivables. Plus, if you discover that your ratio is particularly high or low, you can work on adjusting your policies and processes to improve the overall health and growth of your business. Moreover, although typically a higher accounts receivable turnover ratio is preferable, there are also scenarios in which your ratio could be too high. A too high ratio can mean that your credit policies are too aggressive, which can lead to upset customers or a missed sales opportunity from a customer with slightly lower credit. Receivables turnover ratio is more useful when used in conjunction with short term solvency ratios like current ratio and quick ratio.

- The receivables turnover ratio calculator is a simple tool that helps you calculate the accounts receivable turnover ratio.

- Think of an Accounts Receivable Turnover Ratio Calculator as a financial detective, uncovering how efficiently your business collects payments from its customers.

- In this guide, therefore, we’ll break down the accounts receivable turnover ratio, discussing what it is, how to calculate it, and what it can mean for your business.

- Centerfield Sporting Goods specifies in their payment terms that customers must pay within 30 days of a sale.

The receivables turnover ratio calculator is a simple tool that helps you calculate the accounts receivable turnover ratio. The turnover ratio is a measure that not only shows a company’s efficiency in providing credit, but also its success at collecting debt. This article will explain to you the receivables turnover ratio definition and how to calculate receivables turnover ratio using the accounts receivable turnover ratio formula. Additionally, you will learn what does a high or low turnover ratio mean, and what are the consequences of each.

Making decisions based on your accounts receivable turnover ratio

Companies need to know their receivables turnover since it is directly tied to how much cash they have available to pay their short-term liabilities. If the accounts receivable turnover is low, then the company’s collection processes likely need adjustments in order to fix delayed payment issues. The receivables turnover ratio is related to the average collection period, which estimates how long the weighted average customer takes to pay for goods or services. Here is a receivables turnover calculator, which computes how quickly a company turns over its receivables, or sales extended on credit to customers. Enter the company’s net credit sales (or, optionally, top line sales) and two period’s accounts receivable to compute the ratio.

With 90-day terms, you can expect construction companies to have lower ratio numbers. If you’re in construction, you’ll want to research your industry’s average receivables turnover ratio and compare your company’s ratio based on those averages. To identify your average collection period, divide the number of days in your accounting cycle by the receivables turnover ratio. Now that you know the secret to the accounts receivable turnover ratio formula calculator, the next section will use an example to show you how to calculate the receivables turnover ratio.

Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

The Accounts Receivable Turnover is a working capital ratio used to estimate the number of times per year a company collects cash payments owed from customers who had paid using credit. Investors can also use it to compare the ratio of different companies in the market because generally companies from the same industry operates in a similar way and should have similar accounts receivable turnover ratio. This investment comparison approach is not recommended for the comparison of companies operating in different industries. If you are an investor considering investing in a company, you should check its account receivable turnover ratio and look for a high ratio. Generally, a high ratio will be an indicator that the company has a good credit policy and good customer base, which means a high probability that your investments will be safe and hopefully start growing. However, if the company is using a really tight credit policy it might start losing its client base, which means they should reconsider their policies even if it means a slight decrease in accounts receivable turnover ratio.

The denominator of the accounts receivable turnover ratio is the average accounts receivable balance. This is usually calculated as the average between a company’s starting accounts receivable balance and ending accounts receivable balance. Companies with efficient collection processes possess higher accounts receivable turnover ratios. The Accounts Receivable how to calculate cost per unit Turnover Ratio indicates how efficiently a company collects the credit it issued to a customer. Businesses that maintain accounts receivables are essentially extending interest-free loans to their customers, since accounts receivable is money owed without interest. The longer is takes a business to collect on its credit, the more money it loses.