Imagine owning a home, or an alternative house? The debt is a significant area of the (mortgage) picture that you should consider. Here’s how lenders see your financial obligation when you want to get otherwise re-finance property or property when you look at the Canada.

The debt actually the weighed similarly in the sight off a lender.

Have you got loans? You aren’t by yourself. According to a report away from TransUnion Canada, up to ninety-five% from credit users bring a balance, a good step three.7% raise over last year.

Borrowing fee wide variety plus expanded by way of most recent higher interest rates: repayments to your playing cards increased of the eleven%, auto loans by six%, and you may lines of credit of the 13%. Plus, which have a rise during the Canadian newcomers, borrowing from the bank account open and ballooned because of the 46% regarding 2022 to help you 2023.

Of the stats, we have found something you should bear in mind. Having an effective credit history can help you secure a home loan financing. And you can handling your debt well helps you purchase your very first domestic or qualify for a top home-rates matter or a reduced rate of interest.

Did you know certain types of obligations can be weigh hefty on your home loan pre-recognition? When you’re loan providers like to see a varied credit score, not all your debt try viewed in the same way. The following is a review of exactly how your debt can affect the home loan money.

This is how different kinds of loans can affect your own acceptance.

Loan providers have a tendency to remove a loans in another of a couple ways: they’re going to sometimes use the whole equilibrium (that they estimate for the ‘monthly’ repayments at their unique percentages), or they’ll use the genuine payment per month struck on the cash move. Including, for the conclusion, certain types are easier to budget and you can lower than others – assisting to keep the debt solution ratios off and you may credit rating up.

Will be your debt incorporating difficulty on financial, even if you has good credit? If you would like consolidate loans, combine several mortgages, otherwise you would like a preliminary-title enhance observe your courtesy a short-term difficulties room, we could possibly have the ability to assist. Read more here.

Federal Financial obligation

Canada Funds Institution (CRA). Whole balance, paid down asap. Such personal debt is a fast no-wade. For individuals who owe straight back fees otherwise come into arrears, you will be requested to clear so it personal debt before a loan provider tend to consider carefully your pre-acceptance.

Bank card, Line of credit Debt

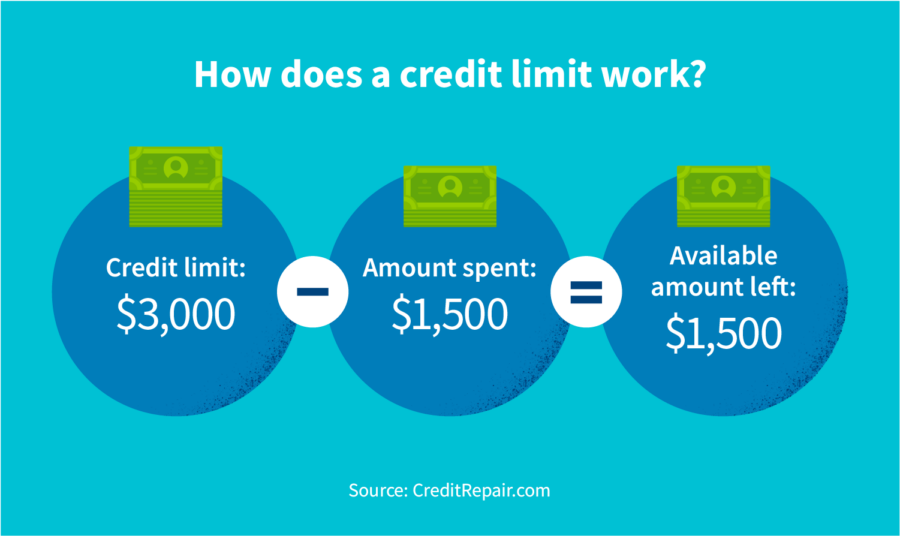

Revolving, Unsecured. Whole harmony. Because of it types of debt, a loan provider generally looks at the complete harmony to help you estimate an enthusiastic number you should be expenses each month to pay off it off, no matter what far you actually pay down a month. The greater the bill, brand new instant same day payday loans online New Jersey less it can add up during the lender calculations, and the much more it works up against your own home loan-borrowing prospective.

- Loan providers want to see normal costs on this subject version of financial obligation, especially if you carry stability out-of week-to-day (don’t save money than 75% of limit, or obvious what you owe commonly when you do).

- The latest ‘minimum’ count is just that and will work against your own credit history for individuals who always pay just it number.

- Even after uniform repayments, higher stability commonly still foundation in the borrowing usage speed and you can debt services percentages – whether or not a lender could possibly get consider the texture on your own complete borrowing from the bank image.

- That have a line of credit (LOC), specific lenders will get foot the computations towards entire restriction, no matter equilibrium.

Home loan Financial obligation

Shielded. Monthly-fee amount. A mortgage is a kind of instalment financial obligation, however, usually much larger and therefore paid off over multiple more many years (twenty five years is actually practical). Lenders will use your own possible payment per month according to your own value number otherwise your own genuine payment for people who currently have home financing.